Over the past several years traditional institutions worldwide, in order to stay ahead of competitors and to compete globally, have migrated their businesses information into digital form. This has introduced new risks including formidable cyber attacks. Moreover, as if cyber assaults were not perilous enough, there is a new stressor and major disruptor at play known as the ‘sharing economy.’

The Sharing Economy is reshaping organized economic activity, shifting us from affairs conducted within traditional institutions towards new funding methods.

- Peer-to-peer (P2P) marketplaces allow several investors to fund loans by matching up the borrowers and lenders through an online marketplace.

- Funding projects and or ventures by raising contributions from a large number of people. Think-crowdfunding and cryptocurrencies.

- Crowdfunding provides capital to start-ups or to further ongoing ventures; Entry to principal with a hedged risk; A simpler source of funding than traditional conduits.

- Cryptocurrencies, Bitcoin, and Blockchain practices are increasingly becoming accepted.

In its sum, it is a new and unconventional socio-economic system which embeds sharing and collaboration across all phases of social and financial life.

The sharing economy that started with bikes and cars has now evolved to taxis and hotels with a keen focus set on industry giants including financial services and their intermediaries.

Until recently financial institutions and their intermediaries-insurance, banking, and financial management giants have prevented innovative more nimble market entrants from breaking into the financial services industry. However, as the sharing economy picks up speed led by the accelerated pace of technology, it has become increasingly ‘disruptive.’

This disruptive force is called Financial Technology, also known as FinTech, which is comprised of companies that use innovative technology to leverage available resources to compete in the open market of traditional financial institutions in the delivery an array of financial services.

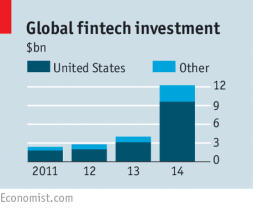

These disruptors are often start-ups, fast-moving companies focused on the  most profitable elements-mobile payments to insurance. Industry analysts estimate that traditional financial services industries could be at risk of being lost to standalone FinTech companies within 5 years.Additionally, FinTech is making an impact on the industry tripling to more than $9+ billion in the US in 2014 alone. (Economist.com)

most profitable elements-mobile payments to insurance. Industry analysts estimate that traditional financial services industries could be at risk of being lost to standalone FinTech companies within 5 years.Additionally, FinTech is making an impact on the industry tripling to more than $9+ billion in the US in 2014 alone. (Economist.com)

Having worked in the financial service sector for several years, I learned that besides being large, bloated and cumbersome the one thing many of them share is that they loathe change. The mere mention of change would set their ‘hair on fire’. However, without change, there is no growth, and eventually, the lumbering giants will need to evolve or be overtaken.

The shift toward using technology, cryptocurrencies and blockchain technologies to improve productivity, availability and functionality in financial services and intermediaries is a reflection of the 21st century-the digital era.

Hold da op, sikke en fantastisk præmie. Den ville jeg super gerne have fingrene i. Det er nogle meget smukke og specielle billeder han laver. Hilsen en fast læser, desƒÃv¦rre bare uden en blog. Mvh Heidi

LikeLike

F*ckin’ awesome things here. I’m very glad to see your post. Thanks a lot and i’m looking forward to contact you. Will you kindly drop me a e-mail?

LikeLike

Thank you so much for your comment.

LikeLike